As a dedicated business owner, you understand that investing in quality equipment can significantly impact your success. With the Section 179 tax deduction, purchasing a PJ Trailer can be both a wise operational decision and a potential way to save on taxes. Let’s explore how you can benefit from this opportunity in 2024.

Understanding the Section 179 Deduction

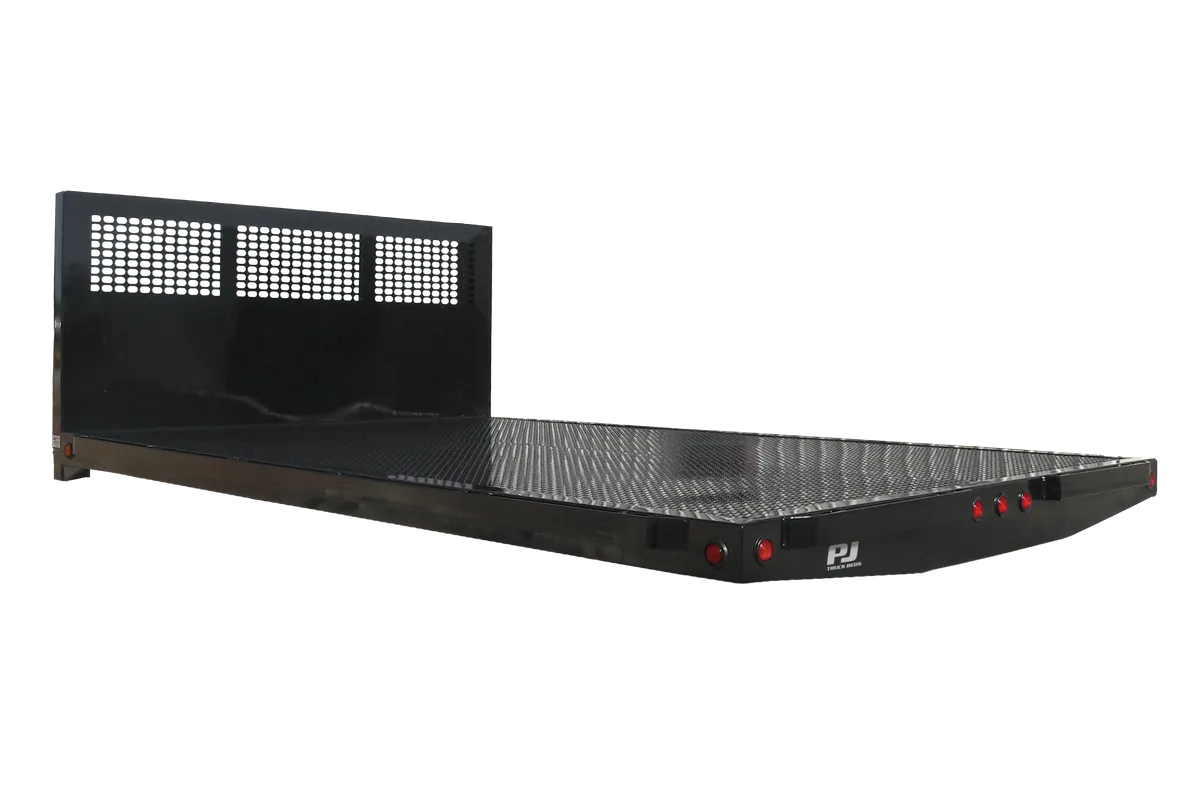

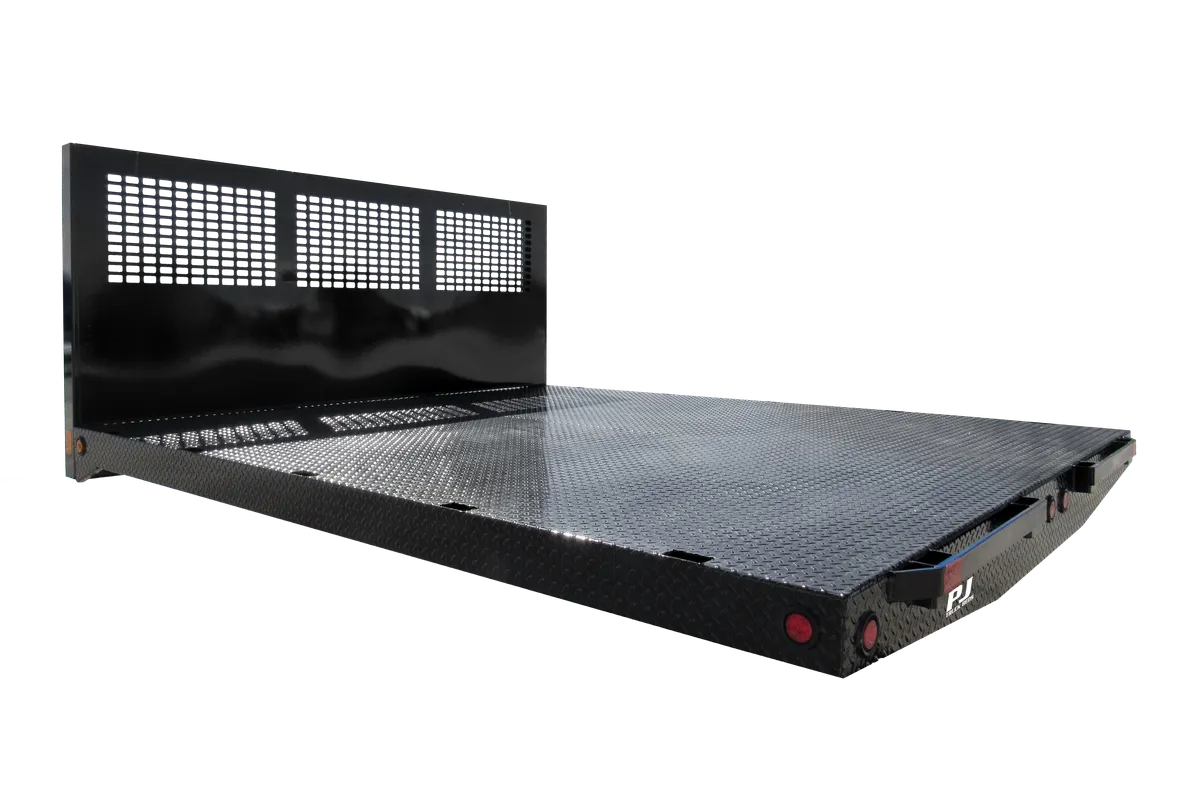

Section 179 allows businesses to deduct the full purchase price of qualifying equipment, such as trailers, from their taxable income in the year of purchase. This means when you buy PJ Trailers—known for their strength and reliability—you’re also maximizing your tax savings.

2024 Deduction Limits

This year, the maximum deduction under Section 179 is $1,220,000, with an equipment spending cap of $3,050,000. If your total equipment purchases exceed the cap, the deduction reduces dollar-for-dollar, phasing out at $4,270,000. Plus, there’s a 60% bonus depreciation available to boost your tax benefits.

Why Choose PJ Trailers?

Our trailers qualify for Section 179 and offer the quality you need to tackle any job. Be sure to check with your local PJ Dealer by December 31, 2024, they have plenty of of models in stock and ready to haul home today. Just remember, the trailer you select must be used for business purposes at least 50% of the time to qualify.

Act Now to Maximize Your Tax Savings

Don’t miss this chance to invest in your business and maximize your tax savings. Contact your nearest PJ Trailers Dealer and consult with a tax advisor to get started.